The global patent landscape has been rife with activity due to the emergence of the unmanned aerial vehicle (UAV) or the more widely-used term “drone”. In France, the UAV is generally known as the drone, and in the United States and the UK, the term Unmanned Aircraft Systems (UAS) was adopted by the Federal Aviation Administration (FAA) and European Aviation Safety Agency (EASA). The UAS and UAV terms differ as defined, however, as the UAS consists of a UAV, ground control station with a pilot, communications equipment, support/launch systems, etc., making the UAS term much more encompassing.

To further the confusion, the terms (UA) Unmanned Aircraft, (RPA) Remotely Piloted Aircraft, (MAV) Micro Air Vehicle, (RPAS) Remotely Piloted Aircraft System are all also applicable.

Industry Adoption

The versatility that UAVs or drones offer makes them extremely valuable to four industries: military, consumer goods, transportation, and agriculture. Functioning either by remote control or onboard computers, the increasing development of autonomous technologies is a boon to the drone patent landscape.

The first documented use of UAVs dates back to the mid-1800s when Austrian forces attacked the city of Venice using an estimated 200 explosives-filled balloon carriers. Since then, drones have been deployed primarily in a military context. With a history of technological advancements upgrading the efficiency of UAVs from World War II to the present, international interest in drone technology has led to its increased usage in commercial fields.

With the commercial potential of drone technology gaining recognition, the Federal Aviation Administration (FAA) issued the first commercial drone permits in 2006. The introduction of commercial drone permits increased the potential scope of usage for consumer drones and helped pave the way for innovation. One noteworthy innovative use of commercial drone technology was Amazon’s proposed delivery system by drone introduced in 2013. After the introduction of commercial drone permits, commercial drone usage expanded to industries such as agriculture, real estate, sports, security, and insurance.

Advancements in both the underlying technology and ancillary functions have opened the doors for even more UAV innovation. Recreational, commercial, and military drones have seen upgrades such as advanced navigation systems, increased range, data storage, and surveillance systems. The exponential growth of UAV technology has led to a surge in drone patent filings. New and existing patent filings may offer a glimpse into a future with new uses for drone technology, whether through autonomous drone taxis or indoor assistant drones.

Emerging and Existing UAV Technologies

Most UAVs are composed of the same physical parts. A basic drone consists of a body, power supply, system hardware/processor(s), internal and external sensors, actuators, and autopilot software. A drone’s sensors calculate external distance measurements and can detect external formations to avoid collisions. The power supply of a UAV ranges from lithium-polymer batteries to standard airplane engines. UAVs also possess software in the form of a flight stack consisting of firmware, middleware, and an operating system that manages flight control, navigation, and decision-making.

Many residential, commercial, and military drones feature technology geared towards the autonomous nature of the vehicle. An attached GPS allows the vehicle to navigate its course to a desired path or back to its point of origin. Aircraft and ground-based sensors help UAVs manage takeoff and landing. An altitude hold function, usually controlled by a barometric pressure sensor, ultrasonic sensor, and a throttle stick, allows drones to maintain and shift their attitudes.

Ideas for potential future drone technologies held by patent holders may shape future usage of UAVs. Such technologies include hydrogen-powered drones, improved computer vision, environmental awareness, and autonomous recharging. Some possible future uses of UAVs include autonomous taxis and public transportation, drone waitstaff, and flying personal assistants.

Major Players in the UAV Industry

With the recreational and commercial use of drones growing exponentially, the UAV industry is filled with companies expanding their patent holdings and contributing to the technological advancement of autonomous aircraft. Chipmakers such as Texas Instruments Inc., Microchip Technology Inc., and Xilinx Inc. are some of the companies responsible for creating the microprocessors that help power drone technology. Companies that provide cloud computing services such as Amazon Web Services, Alibaba Group, and Microsoft Azure help power the data collection, storage, and analysis done by most drones. As we have seen in the consumer industry, leveraging customer behavior data to generate behavioral insights leads to an increase in sales growth and strengthened strategies. The data collected will be key to customer acquisition, retention and growth.

As the FAA projects that over 1.6M consumer (model) drones will be registered and in operation in the U.S. by 2023, drone makers will continue to see a surge in business. Further, the FAA also forecasts that 835,000 sUAS (non-consumer) drones will also be registered in that same time frame; leading the way for ASPs from $2,500 to $25,000 based on technology enhancements. Companies such as Lockheed Martin, Boeing Co., and Aerovironment Inc. are three of the largest producers of sUAS drones. Chinese companies such as DJI and Yuneec International are two of the largest consumer (model) drone manufacturers who have gone toe-to-toe with each other over U.S. patent infringement claims (2016).

Overall, a large majority of companies active in the UAV industry remain private. Some of the leading public companies active in the UAV industry include MOOG Inc., Ballard Power Systems, EMCORE Corporation, GoPro, Parrot, Ambarella, and CIRCOR Aerospace.

Patent Research

Looking at the major drone industry companies, in various countries, TechPats has seen that advancements in both the underlying technology and ancillary functions have opened the doors for even more UAV innovation and resulting IP development.

Many of the technology areas below will see continued innovation based on the growth of the UAV industry. As you will find, most of these technologies are ubiquitous to both the Autonomous Driving and Robotics industries:

- GPS

- GNSS

- INS

- MEMS

- GaAs Solar

- Hydrogen Fuel Cells

- RADAR/LiDar

- Wireless/Cellular Communications

- Satellite Communications

- Optoelectronics

- Photonics

- Actuators/Connectors

In their own right, each of the above technology areas bring significant value to the UAV industry, however there are two technologies TechPats believes will be of primary focus and value to the UAV industry given their respective impact on navigation, security and collision avoidance.

Infrared Thermography (IRT) and Hyperspectral Imaging (HSI) are two primary technology areas of focus for patenting in the UAV industry. They revolve around UAV’s camera based navigational systems. The Gyro-stabilized Gimbal, generally located at the lower base of the UAV, provides housing for the UAVs most critical systems, including inertial navigation, laser range finders, and thermal imaging and hyperspectral cameras. These types of cameras are critical to the use of UAVs. Similar to the impact of LBS, GPS and GNSS technology in mobile handsets and consumer electronics, it is our belief that both Thermal Imaging and Hyperspectral imaging will have a future impact on both of these industries as well.

Infrared Thermography (IRT) has been used in various industries for years. However, more recent advancements in specialized thermal imaging cameras use focal plane arrays (FPAs) that make use of uncooled microbolometers as FPA sensors. IRT has been used in military applications for years but will strengthen consumer applications moving forward.

Hyperspectral Imaging (HSI) is an emerging field in which the advantages of optical spectroscopy as an analytical tool are combined with two-dimensional object visualization obtained by optical imaging. Use cases for hyperspectral imaging include chemical materials exposure, astronomy, facial recognition, mineralogy, food processing, and pesticide application.

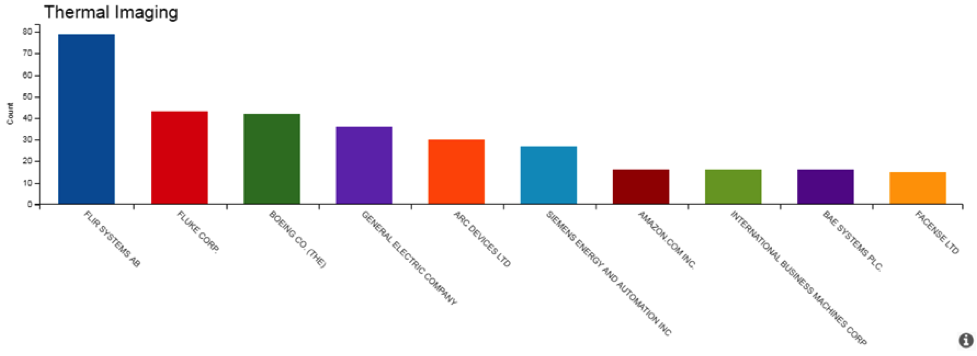

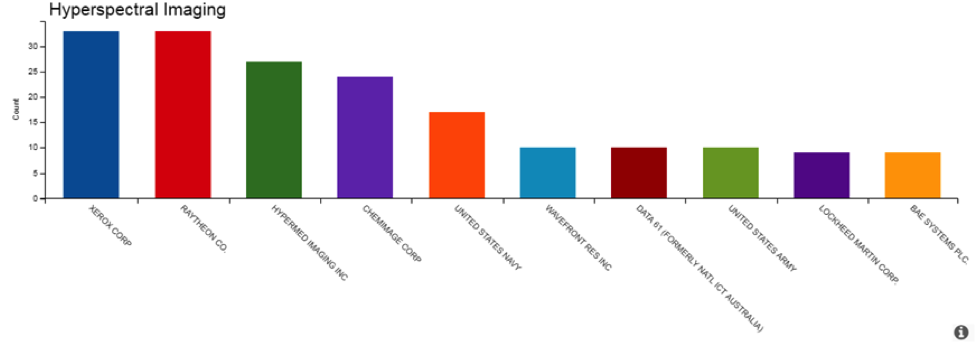

Below are the companies who hold the most U.S granted patents in Thermal and Hyperspectral Imaging:

Leading Innovators in Thermal Imaging

Leading Innovators in Hyperspectral Imaging

FLIR – Leading Thermal Imaging Innovator

As of 2019, Oregon based FLIR Systems (Nasdaq: FLIR) is a leading public company and patent holder in the UAV supply chain. FLIR brings innovative sensing solutions into daily life through their thermal imaging, visible-light imaging, video analytics, measurement and diagnostic, and advanced threat detection systems.

To the UAV industry, FLIR is a leading innovator with approximately 450 U.S. granted patents and a WW portfolio of over 600 granted patents. FLIR’s UAV market product offerings include: Infrared Camera Cores, Spherical Imaging Systems, Laser Range Finders (VCSEL based), Focal Plane Arrays (FPAs), Illuminators, Packaged Sensors and Software Development. In addition, FLIR’s acquisition of Aeryon Labs gives it drone manufacturing capabilities to bring their advanced technologies to market.

With the focus of camera-based technologies in consumer goods (iPhone 11) and the rising interest for consumer goods transportation by UAV (Amazon), it would be of no surprise to this team if FLIR wasn’t on a leading tech companies M&A radar for 2020. The applications for FLIR’s camera technology in smartphones, security systems, smart home, and automotive markets are endless. From identifying a skin rash, detailing remaining shelf life of fresh food in a smart fridge, to successfully supporting a covert military operation, FLIR’s products and technology advancements rank high in TechPats opinion of companies active in the UAV industry. Most importantly, FLIR holds intellectual property in high regard, acquiring a portfolio of patent assets from ARIA Insights in October of 2019 and the i-Robot military spin-off, Endeavor Robotics, in March of 2019.

For more information on FLIR, please visit www.FLIR.com OR view their most recent investor presentation here.

DJI – Drone Manufacturing Leader

As of 2019, Chinese drone manufacturer SZ DJI Technology holds the distinction of being one of the world’s largest drone patent holders and also has a partnership with FLIR. DJI’s patent portfolio ranks at the top of the international top ten list, with over 750 worldwide patents granted. DJI continues to be a leading innovator in the UAV industry and has filed patents for technologies including assembly, imaging, sensors, pet walking, photography, and self-tightening rotors.

One of DJI’s primary drone manufacturing competitors, France-based Parrot SA, holds approximately 269 granted worldwide patents, less than half of DJI’s current portfolio. It is evident that the key to success in the UAV industry will be innovation.

For more information on DJI, please visit www.dji.com

Noteworthy UAV Innovator

A noteworthy mention is Canada-based Hexagon Positioning which recently acquired NovAtel and has a worldwide portfolio of over 1100 granted patents. Hexagon is an equipment manufacturer specializing in GPS/GNSS/INS antennas, firmware, software, and navigational correction services. The company offers anti-jamming, positioning, and trajectory services for the autonomous vehicle, agriculture, defense, and surveying industries. Hexagon’s patent portfolio is one of the largest in GPS and Location Based Services which are directly applicable to the UAV market.

For more information on Hexagon Positioning, please visit www.hexagonpositioning.com

Summary

TechPats has identified over 200+ companies active in UAV manufacturing and the UAV supply chain. Further, we have knowledge of technologies contained in patent portfolios held by many public companies active in this industry, including FLIR Systems (FLIR), Ballard Power Systems (BLDP), EMCORE Corporation (EMKR), and Teledyne Lumenera (TDY).

If you have any questions on the UAV market, emerging/pervasive technologies, or require technical support for M&A strategy, please feel free to contact TechPats at the email below.

For more information, please contact William O’Donnell at wodonnell@techpats.com.

TechPats’ Technical Excellence and Patent Expertise

Whether you’re an investor, general counsel, inventor, or CEO with an interest in UAV technology, protecting and optimizing your IP portfolio is essential. TechPats is the world’s leading full-service intellectual property consulting firm specializing in claim charts, infringement analysis, reverse engineering, testing services, and IP monetization strategy. Maximize your UAV patent portfolio and gain peace of mind with TechPats’ unmatched IP and technical excellence.

For more information on TechPats and its services, contact us today.